Systemic Risk in Wall Street

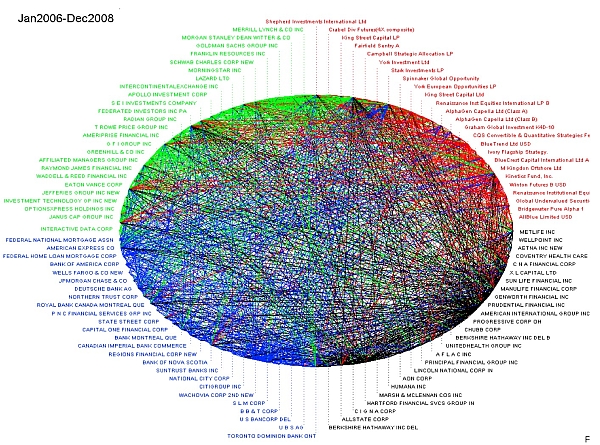

Econometric Measures of Connectedness and Systemic Risk in the Finance and Insurance Sectors by Monica Billio, Loriana Pelizzon, Andrew W. Lo, and Mila Getmansky is a project that tries to come up with hard definitions of interconnectedness and systemic risk in the financial industry.

Too me, one of the most appealing is the data posted on these two charts which show financial industry interconnectedness in the 90s, and then prior to the 2008 crisis. The dramatic increase in financial ties between banks, hedge funds, insurance companies and other investment companies is remarkable. By 2012, it is unlikely that risk is less.

In the meantime, the United States government and the declining wealth of the American people continue to back efforts to sustain the system in a massive looting operation. The world is hurting, but the American people are hurting most. What wealth exists is on paper. If you have physical gold and silver, you should hide it well, since most governments have the declared the “right” to confiscate that wealth.

Americans Poorest Since 2008

The wealth of Americans wealth suffered its biggest quarterly loss in more than two years as stocks, pension funds and home values lost value this last quarter. Household net worth fell 4 percent to $57.4 trillion in the July-September quarter according to the Federal Reserve. This has been the sharpest drop since the October-December quarter of 2008 and the second straight quarterly decline, lending more evidence to a second part of the double dip recession-depression that the some experts have expected.

The wealth of Americans wealth suffered its biggest quarterly loss in more than two years as stocks, pension funds and home values lost value this last quarter. Household net worth fell 4 percent to $57.4 trillion in the July-September quarter according to the Federal Reserve. This has been the sharpest drop since the October-December quarter of 2008 and the second straight quarterly decline, lending more evidence to a second part of the double dip recession-depression that the some experts have expected.

Many foreclosures have been delayed because of a government investigation into mortgage lending practices. That won’t continue because millions of homes are substantially past-due on mortgages. Mortgage debt is declining because so many Americans are defaulting on payments.

The value of Americans’ stock portfolios fell 5.2 percent last quarter. Home values dropped 0.6 percent, which continue to be artificially inflated by the finance industry. During this financial blight, multinational corporations continue to sock greenbacks away to the tune of $2.1 trillion last quarter.

Who is spending most? The richest 20 percent represent about 40 percent of consumer spending, if that means anything. Stock and bond wealth is held by the richest Americans, who also account for a disproportionate amount of consumer spending. Eighty percent of stocks belong to the richest 10 percent of Americans. Does this suggest you should stay with Wall Street investment or is the world looking at another financial bubble destined to explode. My report tomorrow should give you some ideas.

For most Americans, declining wealth is combined with stagnant incomes. Since consumers allegedly create 70 percent of economic activity, the picture isn’t rosy. For those that have wealth, it’s all on paper, based on a system without a basis for wealth. The dollar and the bankers that print them continually actually means less value, not more. Despite dollar stores and discount prices, your dollar doesn’t stretch as far, a plight that plays out each year. Inflation continues as well, whether official figures show that inflation or not. International bankers don’t have an answer beyond printing more greenbacks, known as quantitative easing.

The World of the Unemployed

Economists have warned that the labor market of the United States will take decades to return to pre-recession employment levels as long as the economy’s slow growth continues. Some have been very excited at the 120,000 temporary jobs added in November, creating a drop in the “unemployment rate.” Half the decline resulted from 315,000 Americans that have officially dropped from the labor market. Americans drop out of the market because they can’t find a job, whether underemployed or otherwise. Government statistics have revised job growth for September up to 210,000 from 158,000, with October’s gains up to 100,000 from 80,000.

Economists have warned that the labor market of the United States will take decades to return to pre-recession employment levels as long as the economy’s slow growth continues. Some have been very excited at the 120,000 temporary jobs added in November, creating a drop in the “unemployment rate.” Half the decline resulted from 315,000 Americans that have officially dropped from the labor market. Americans drop out of the market because they can’t find a job, whether underemployed or otherwise. Government statistics have revised job growth for September up to 210,000 from 158,000, with October’s gains up to 100,000 from 80,000.

250,000 is magic number, usually declared as the number of jobs created for a healthy recovery, but we know that millions of jobs have bit the dust since 2008, with many facing perpetual unemployment. Admittedly, any number of jobs is better than no jobs, even if they are temporary jobs. Job gains are coming from the retail sector, which pull in a median wage of $10.94 an hour. Naturally, many of the jobs earn less for that ‘median’ figure.

Remarkably, we keep hearing that the United States is doing better than Greece and China, even the rest of the world, but this is probably more of a political stand than reality, depending on where you look. The big picture, at best, is uncertain, which is the latest standard in the new economy. Meanwhile, 2 million Americans have been out of work for 99 weeks or more, creating a jobless recovery, due to lack of normative statistics. The inequity of this reality helped to feed the Occupy Wall Street movement. Corporate profits are at all-time high if you listen to economists at Brookings. The evidence tends to support this.

If you see underemployment, temporary jobs and retail work as the American Dream, the U.S. is living large. When you look closer, the U.S. is coming closer to the reality of a third-world nation as bankers and multinationals denude the nation’s economy for their own interests. This will only continue as long as Americans are spoon fed the notion that somebody must offer them a job if they are to be employed. Politicians continue to bow to special interests above the basic needs of a nation of people. Instead of encouraging self-employment and tax-law favorable to that, the U.S. government would rather encourage living on whatever public benefits are available. Actually encouraging self-employment would eventually change the nation instead of expecting to wait decades for crushing poverty to end while huge national deficits continue to fuel the fires of national insolvency. Instead, politicians have created an underground economy and revitalized a system of barter among the new growing poor of the nation.

100 Million Americans In Poverty or Ready For It

If the current unemployment numbers, the nearly 50 million on government food assistance, combined with nearly non-existent savings accounts, anemic real estate values and a static real estate market, and the runaway printing of the dollar are not enough to convince you that the nation is headed for depression, the nation has cold reality looking it in the face that nobody wants to talk about. Multitudes of U.S. citizens are part of a diverse group of near poor, people that continue to be overlooked.

The U.S. Census Bureau released a new measure of poverty that was designed to better count disposable income. The most startling differences between the old measure and the new involves data the government has not yet published. This big secret is that 51 million additional people have incomes near the poverty line. That number of Americans is 76 percent higher than the official account published in September. That places 100 million people either in poverty or just above poverty. This current scenario counts on stability, which we don’t have.

After decades of poor wages for so many Americans and the worst downturn since the Great Depression, the findings show the reality of what America really faces, but has been quick to deny. “These numbers are higher than we anticipated,” said the bureau’s chief poverty statistician. “There are more people struggling than the official numbers show.”

With the Euro in the toilet today because of a failing bond issue, reality is not going to get better any time soon. We’re in for rocky times ahead. One hundred million people are barely able to keep themselves fed and sheltered. Tens of millions more will join the ranks of the near poor over coming years regardless of the good news you hear. Why? The good news isn’t good enough to pull America out of the banker’s ash can.

As more people become part of the near poor, more debt and government bonds will need to be issued. Consider the reality of rising prices in essential goods like food and energy and we have an intensifying situation at hand. The Chinese aren’t likely to want to buy more U.S. bonds to sustain the unemployed and to buy food stamps for millions of needy Americans. The bankers of the Fed will simply print more greenbacks. Many Americans are buying their way into a temporary sense of comfort this holiday season. The ensuing feeling of panic and abandonment are likely to rise as overextended Americans and bad news overseas place additional pressure on the house that international bankers built. You can see why American agencies have already prepared for national unrest behind the scenes, while politicians wink uncomfortably at the Occupy Wall Street folks.

TSA Now on Tennessee Highways

by Rep. Ron Paul, October 25, 2011

If you thought the Transportation Security Administration would limit itself to conducting unconstitutional searches at airports, think again. The agency intends to assert jurisdiction over our nation’s highways, waterways, and railroads as well. TSA launched a new campaign of random checkpoints on Tennessee highways last week, complete with a sinister military-style acronym — VIPR — as a name for the program.

As with TSA’s random searches at airports, these roadside searches are not based on any actual suspicion of criminal activity or any factual evidence of wrongdoing whatsoever by those detained. They are, in effect, completely random. So first we are told by the U.S. Supreme Court that American citizens have no 4th Amendment protections at border crossings, even when standing on U.S. soil. Now TSA takes the next logical step and simply detains and searches U.S. citizens at wholly internal checkpoints.

The slippery slope is here. When does it end? How many more infringements on our liberties, our property, and our basic human rights to travel freely will it take before people become fed up enough to demand respect from their government? When will we demand that the government heed obvious constitutional limitations and stop treating ordinary Americans as criminal suspects in the absence of probable cause?

The real tragedy occurs when Americans incrementally become accustomed to this treatment on the roads just as they have become accustomed to it in the airports. We already accept arriving at the airport two or more hours before a flight to get through security; will we soon have to build an extra two or three hours into our road trips to allow for checkpoint traffic?

Worse, some people are lulled into a false sense of security and are actually grateful for this added police presence! Should we really hail the expansion of the police state as an enhancement to safety? I submit that an attitude of acquiescence to TSA authority is thoroughly dangerous, un-American, and insulting to earlier, freedom-loving generations who built this country.

I am certain people will complain about this, once they have to sit in stopped traffic for a few extra hours to allow for random searches of cars. However, I am also certain it merely will take another “foiled” plot to silence many people into gladly accepting more government mismanagement of safety.

Vigilant, observant, law-abiding, gun-owning citizens defend themselves and stop crimes every day before police can respond. That is the source of real security in America: the 2nd Amendment right to defend oneself. The answer is for people to be empowered to protect themselves. Yet how many weapons might these checkpoints confiscate? Even when individuals go through all the legal hoops of licensing and permits, the chances of harassment or outright confiscation of weapons and detention of citizens when those weapons are found at a TSA checkpoint is extremely high.

Disarming the highways and filling them full of jack-booted thugs demanding to see our papers is no way to make them safer. Instead, it is a great way to expand government surveillance powers and tighten the noose around our liberties.

Tennessee Becomes First State To “Fight Terrorism” Statewide

By Adam Ghassemi, Channel 5 News

PORTLAND, Tenn. – You’re probably used to seeing TSA’s signature blue uniforms at the airport, but now agents are hitting the interstates to fight terrorism with Visible Intermodal Prevention and Response (VIPR).

“Where is a terrorist more apt to be found? Not these days on an airplane more likely on the interstate,” said Tennessee Department of Safety & Homeland Security Commissioner Bill Gibbons.

Tuesday Tennessee was first to deploy VIPR simultaneously at five weigh stations and two bus stations across the state.

Agents are recruiting truck drivers, like Rudy Gonzales, into the First Observer Highway Security Program to say something if they see something.

“Not only truck drivers, but cars, everybody should be aware of what’s going on, on the road,” said Gonzales.

It’s all meant to urge every driver to call authorities if they see something suspicious.

“Somebody sees something somewhere and we want them to be responsible citizens, report that and let us work it through our processes to abate the concern that they had when they saw something suspicious,” said Paul Armes, TSA Federal Security Director for Nashville International Airport.

The Tennessee Highway Patrol checked trucks at the weigh station with drug and bomb sniffing dogs during random inspections.

“The bottom line is this: if you see something suspicious say something about it,” Gibbons said Tuesday.

The random inspections really aren’t any more thorough than normal, according to Tennessee Highway Patrol Colonel Tracy Trott who says paying attention to details can make a difference. Trott pointed out it was an Oklahoma state trooper who stopped Timothy McVeigh for not having a license plate after the Oklahoma City bombing in the early 1990s.

Tuesday’s statewide “VIPR” operation isn’t in response to any particular threat, according to officials.

Armes said intelligence indicates law enforcement should focus on the highways as well as the airports.

—-

Back in 2006, I found a suspicious group of foreigners running a restaurant right in the midst of Nashville on Nolensville Road as my wife and I sought a new place to eat. They were running tapes of a Muslim Imam (presumably speaking in Farsi) and the place smelled of gunpowder. An interested citizen of Tennessee was in active conversation with a Arab man at the front by the front door. They didn’t have any food, the man behind the counter said, and would have to order out, so my wife and I left. The food that was sitting behind the counter, your dog would not have eaten. Later, when I called the police and gave them details about the “restaurant,” they refused to take me seriously, and my call was passed around for more than an hour with all kinds of dubious questions. They weren’t equipped to deal with such matters. Finally, I gave them a piece of my mind and hung up the phone, emailing them personally about our experience. I told them I was finished with the matter and that I would not attempt to report this to any other agency. That is the typical way that Tennessee deals with suspicious people. That was in 2006. Now truck drivers are being inspected. Shouldn’t we all feel better? While this seems harmless, all they need to do is to direct all traffic through these checkpoints and your civil rights are in question. You are being inspected because you are driving on a certain highway, this personal invasion without cause. ~ E.M.

Americans Are Angry

The Occupy Wall Street movement is gaining tons of momentum and is likely to continue picking up steam in the weeks and months ahead. Americans are angry but they aren’t exactly sure what they are angry about and they don’t know for sure who they should be angry with. It is easy for them to point their fingers at Wall Street, but Wall Street is in no way responsible for the financial crisis our country has today. (E.M. is not in total agreement here, this is still a moral crisis of huge proportions.)

NIA believes that Occupy Wall Street protesters need to be educated to the facts and truth about the U.S. economy and what is truly causing our economic problems. NIA is getting ready to release ‘Occupy Wall Street the Documentary’, which NIA has produced so that Occupy Wall Street protesters can understand exactly what changes need to be made in America if our country is going to survive the Hyperinflationary Great Depression that will soon hit America and steal all remaining purchasing power that the U.S. dollar still has left.

NIA first saw signs of the protests taking place today back in November of 2009 when we were in Beverly Hills filming our documentary ‘The Dollar Bubble’. We were alerted by NIA members to a major protest that was breaking out at the University of California. We went to see it and witnessed a very violent protest of students upset about a 32% increase in college tuition for the next semester.

The UCLA protest showed us just how angry Americans can become about inflation. Because we were forecasting massive food inflation to start breaking out in 2010, we made the prediction that we would see large “End the Fed” protests beginning in 2010. We did see massive food inflation in late 2010, accelerating greatly throughout 2011. However, we overestimated the ability for average Americans to quickly point the finger at the Federal Reserve. We also didn’t expect many citizens of foreign countries, especially Arab nations, to begin protesting before Americans did.

About one year after the violent UCLA tuition inflation protest that we witnessed, a larger even more violent tuition inflation protest broke out in London. When Prince Charles’ security detail made the mistake of driving him and the Duchess of Cornwall past the area where the protest was taking place, in a vehicle that cost more than what each protester will earn in the next ten years combined, about 50 of the protesters broke through the motorcycle police protecting the Prince chanting “Off with their heads!”, beating on the side of their Rolls-Royce with sticks and bottles. Luckily, the car was armored and only suffered minor damages, keeping Prince Charles and the Duchess safe. A Jaguar behind it containing police officers was destroyed to the extent that the officers ended up using car doors from the Jaguar as shields, which still couldn’t prevent six of them from being seriously injured.

The food inflation protests that NIA had been expecting for over a year, started to break out in late January of this year in Algeria, with citizens chanting “Bring Us Sugar!” Eight citizens were killed during the protests in Algeria. This quickly spread to a massive outbreak of civil unrest in neighboring Tunisia, where thousands protested food inflation and high unemployment. The Tunisian revolution led to the ousting of longtime President Zine El Abidine Ben Ali, but came at the expense of 79 protesters being killed.

This rapidly spread to the riots in Egypt. Before the Egyptian protests even began, six Egyptian citizens committed suicide in front of government buildings by dousing themselves with fuel and lighting themselves on fire. All together, 846 protesters were killed across different parts of Egypt and over 6,000 more were injured. The Egyptian protesters were eventually successful at getting Egyptian President Hosni Mubarak to resign from office.

NIA saw the resignation of Mubarak as a farce from the beginning. We couldn’t understand how thousands of angry Egyptians who were calling for Mubarak’s head would within seconds of his resignation announcement erupt into cheers like Egypt had just won the World Cup. The resignation of one man would not eliminate the corruption in Egypt’s government and fix their inflation and jobs crisis. Most of Mubarak’s cronies are still in power. Mubarak agreed to just take one for the team. For the protesters to declare victory and go home after one man announced his resignation shows that most of the protesters were sheep who were just copying their friends without having a real grasp on the issues affecting the economy in Egypt. What if Mubarak came back on television and said “I was just kidding” or “I just changed my mind and decided not to resign”, would the protesters have come back?

After Egypt, the protests spread to Jordan and Yemen. Once again, food inflation was the main root cause of the protests, something that the mainstream media in the U.S. largely ignored when reporting on the protests. The American mainstream media was not allowed to discuss inflation when corresponding about the global inflation protests, because it didn’t want the world to connect the dots and realize that Federal Reserve Chairman Ben Bernanke is more responsible for the global food inflation crisis and protests than the leader of any foreign country.

Because of the U.S. dollar’s status as the world’s reserve currency, the majority of the world’s most important agricultural and energy commodities are traded in U.S. dollars. When Bernanke prints trillions of dollars out of thin air in an attempt to reinflate the Real Estate bubble and lower unemployment in the U.S., it has a direct affect on what foreigners pay for all goods and services around the world. With China printing massive amounts of Yuan to keep it pegged to the U.S. dollar and the Bank of Japan intervening to keep the Yen from appreciating too rapidly against the U.S. dollar, countries like Australia are now quick to blame any short-term dip in manufacturing, agriculture production, or energy commodity exports on their currency being too strong against not just the U.S. dollar but the Yen, Yuan, and most other fiat currencies.

In just the last two weeks, the Australian dollar has risen 9.5% against the Yen, 8.5% against the U.S. dollar, and 8.6% against the Yuan. It should be no surprise to NIA members that attempts to copy “Occupy Wall Street” in Australia have been dismal. After 1,000 protesters initially showed up in Sydney on Saturday for their own “Occupy Wall Street” protest that was supposed to continue “indefinitely”, less than 50 protesters remained on Monday as most people returned to work. Australia doesn’t have an inflation or unemployment crisis because their central bank did the right thing and raised interest rates to 4.75% at a time when everybody else was lowering them. This is why since the inception of NIA we have always suggested Australia as our top choice for Americans to move to if they want to get out of harms way before hyperinflation hits the U.S. We hope that the Reserve Bank of Australia will continue to do the right thing and ignore calls from all around the world for them to lower rates.

The mainstream media is currently once again focused on the financial crisis in Europe, which is temporarily distracting from the debt crisis that really matters in the U.S. On Halloween, the official U.S. national debt for the first time ever will surpass U.S. GDP. At any time now without any warning or any new catalyst, we could see a huge onslaught of dollar dumping that causes the economic equivalent of 9/11.

There is no hope of preventing hyperinflation in America when President Obama is unwilling to consider any measure that would cut government spending in a meaningful way. In August when the Budget Control Act of 2011 was enacted by Congress, the mainstream media was widely reporting that the “supercommittee” formed by the act would be in charge of finding $1.5 trillion in spending cuts by Thanksgiving. In reality, this “supercommittee” that Obama was so heavily relying on to pay for his proposals in his “jobs bill”, is not responsible for finding $1.5 trillion in spending cuts but only a $1.5 trillion reduction in the budget deficit over 10 years.

Obama promises to veto any proposals that make large spending cuts, especially to entitlement programs. Many Democrats are calling for a new 5% “surcharge” on Americans earning over $1 million per year. Within a few years, an annual income of $1 million will only have the purchasing power of what a $100,000 salary has today. This proposed new tax would discourage small business owners from expanding and hiring new employees. It would destroy any remaining hope that is left for a real economic recovery and encourage most American entrepreneurs to leave the country permanently.

The U.S. Bureau of Labor Statistics (BLS) yesterday released their consumer price index (CPI) data for the month of September. The BLS reported year-over-year CPI growth of 3.87%, the highest rate of U.S. price inflation in three years. The official government reported year-over-year U.S. price inflation rate of 3.87% for September was up from 3.77% in August, 3.63% in July, 3.56% in June, 3.57% in May, 3.16% in April, 2.68% in March, 2.11% in February, 1.63% in January, 1.5% in December, and 1.1% in November. Year-over-year increases in the CPI have risen by 252% over the last ten months.

Even year-over-year core-CPI growth rose for the 11th straight month to 1.97% in September, an increase of 223% from year-over-year growth of 0.61% in November. NIA estimates the real rate of U.S. price inflation to currently be 8.5% on a year-over-year basis. It was just announced that American retirees receiving Social Security will receive a 3.6% COLA increase, the first increase since 2009. Social Security is the main reason the U.S. government reports artificially low CPI numbers. By giving retired Americans only a 3.6% Social Security payment increase when real price inflation is now 8.5%, Congress gets to spend the difference in the ways they see fit.

With inflation spiraling out of control, the government knows that they soon won’t be able to afford even the artificially low COLA increases they are making today. Congress is now exploring ways to keep future COLA increases as low as possible. Many clueless Keynesian economists in Washington are now arguing that the inflation measure the government uses to calculate COLA increases, the CPI-W, is overestimating true increases in the cost of living. These economists claim that Americans can shift between items and if veal prices are rising too much, they can eat chicken or if lobster prices are rising too much, they can eat shrimp. They propose that the government switches to a version of CPI that accounts for these changes, called “chain weighted” CPI.

All Americans know that their cost to maintain the same standard of living has increased by a lot more than 3.6% over the past year. The CPI-W being used today already artificially understates inflation so much that current Social Security recipients deserve to be receiving triple their current payments. If “chain weighted” CPI was being used today, American seniors would only receive a 3% COLA increase next year.

If the U.S. government did the right thing and invested all FICA tax receipts into gold, it would be able to give Social Security recipients an increase next year of around 8.5% like they should be entitled to. American seniors are being hurt most by inflation because health care has consistently had the highest rate of inflation out of all goods and services. A COLA increase of 3.6% is nothing when NIA estimates the real rate of health care inflation to currently be 15% or 76.5% higher than the overall real rate of price inflation. To artificially lower COLA increases even more would mean utter devastation to the U.S. economy as seniors would need to reenter the workforce and Americans with jobs would need to stop spending money on goods and services in order to help their parents. This would mean even less jobs for the youth in America and less support for them from their parents.

published by National Inflation Association

you can read E.M.’s articles and economic predictions on this website and on the archived Digital Economy.

A Long, Steep Drop for Americans’ Standard of Living

Think life is not as good as it used to be, at least in terms of your wallet? You’d be right about that. The standard of living for Americans has fallen longer and more steeply over the past three years than at any time since the US government began recording it five decades ago.

Think life is not as good as it used to be, at least in terms of your wallet? You’d be right about that. The standard of living for Americans has fallen longer and more steeply over the past three years than at any time since the US government began recording it five decades ago.

Bottom line: The average individual now has $1,315 less in disposable income than he or she did three years ago at the onset of the Great Recession – even though the recession ended, technically speaking, in mid-2009. That means less money to spend at the spa or the movies, less for vacations, new carpeting for the house, or dinner at a restaurant.

In short, it means a less vibrant economy, with more Americans spending primarily on necessities. The diminished standard of living, moreover, is squeezing the middle class, whose restlessness and discontent are evident in grass-roots movements such as the tea party and “Occupy Wall Street” and who may take out their frustrations on incumbent politicians in next year’s election.

What has led to the most dramatic drop in the US standard of living since at least 1960? One factor is stagnant incomes: Real median income is down 9.8 percent since the start of the recession through this June, according to Sentier Research in Annapolis, Md., citing census bureau data. Another is falling net worth – think about the value of your home and, if you have one, your retirement portfolio. A third is rising consumer prices, with inflation eroding people’s buying power by 3.25 percent since mid-2008.

“In a dynamic economy, one would expect Americans’ disposable income to be growing, but it has flattened out at a low level,” says economist Bob Brusca of Fact & Opinion Economics in New York.

To be sure, the recession has hit unevenly, with lower-skilled and less-educated Americans feeling the pinch the most, says Mark Zandi, chief economist for Moody’s Economy.com based in West Chester, Pa. Many found their jobs gone for good as companies moved production offshore or bought equipment that replaced manpower.

“The pace of change has been incredibly rapid and incredibly tough on the less educated,” says Mr. Zandi, who calls this period the most difficult for American households since the 1930s. “If you don’t have the education and you don’t have the right skills, then you are getting creamed.”

Per capita disposal personal income – a key indicator of the standard of living – peaked in the spring of 2008, at $33,794 (measured as after-tax income). As of the second quarter of 2011, it was $32,479 – almost a 4 percent drop. If per capita disposable income had continued to grow at its normal pace, it would have been more than $34,000 a year by now.

The so-called misery index, another measure of economic well-being of American households, echoes the finding on the slipping standard of living. The index, a combination of the unemployment rate and inflation, is now at its highest point since 1983, when the US economy was recovering from a short recession and from the energy price spikes after the Iranian revolution.

The so-called misery index, another measure of economic well-being of American households, echoes the finding on the slipping standard of living. The index, a combination of the unemployment rate and inflation, is now at its highest point since 1983, when the US economy was recovering from a short recession and from the energy price spikes after the Iranian revolution.

In Royal Oak, Mich., Adam Kowal knows exactly how the squeeze feels. After losing a warehouse job in Lansing, he, his wife, and their two children have had little recourse but to move in with his mother. Now working at a school cafeteria, Mr. Kowal earns 28 percent less than at his last job.

He and his wife now eat out once a month instead of once a week, do no socializing, and eat less expensive foods, such as ground chuck instead of ground sirloin. “My mom was hoping her kids would lead a better life than her, but so far that has not happened,” says Kowal.

With disposable incomes falling, perhaps it’s not surprising that 64 percent of Americans worry that they won’t be able to pay their families’ expenses at least some of the time, according to a survey completed in mid-September by the Marist Institute for Public Opinion. Among those, one-third say their financial problems are chronic.

“What we see is that very few are escaping the crunch,” says Lee Miringoff, director of the Marist Institute in Poughkeepsie, N.Y.

Income loss is hitting the middle class hard, especially in communities where manufacturing facilities have closed. When those jobs are gone, many workers have ended up in service-sector jobs that pay less.

“Maybe it’s the evolution of the economy, but it appears large segments of the workforce have moved permanently into lower-paying positions,” says Joel Naroff of Naroff Economic Advisors in Holland, Pa. “The economy can’t grow at 4 percent per year when the middle class becomes the lower middle class.”

He would get no argument from Jeff Beatty of Richmond, Ky., who worked in the IT and telecommunications businesses for most of his career – until he hit a rough patch. He and his wife are living on his unemployment insurance benefits (which will run out in months), his early Social Security payments, and her disability payments from the Social Security Administration. Their total income comes to $30,000 a year.

“Our standard of living has probably declined threefold,” he says.

Mr. Beatty, who used to make a comfortable income, now anticipates applying for food stamps. He and his wife have sold much of their furniture, which they no longer need because they have moved into a one-bedroom apartment owned by his sister-in-law.

Mr. Beatty, who used to make a comfortable income, now anticipates applying for food stamps. He and his wife have sold much of their furniture, which they no longer need because they have moved into a one-bedroom apartment owned by his sister-in-law.

Even people with college degrees are feeling the squeeze. On a fall day, Hunter College graduate and Brooklyn resident Paul Battis came to lower Manhattan to check out the Occupy Wall Street protest. He tells one of the protesters that America’s problem is the various free-trade pacts it has approved.

Mr. Battis’s angst over trade is rooted in the fact that two years ago he lost his data-entry job with a Wall Street firm that decided to outsource such jobs to India.

When he had the job, he made a comfortable income. Now his income is sporadic, from the occasional construction job he lands. He used to buy clothing from Macy’s or other department stores. Now he goes to Goodwill or Salvation Army stores. He has even cut back on taking the city subways, instead riding his bicycle. Separated from his wife and his 15-year-old daughter, he says, “Try making child support payments when you don’t have a regular income. I’m constantly catching up.”

Even recently some Americans could tap the equity in their homes or their stock market accounts to make up for any shortfalls in income. Not anymore. Since 2007, Americans’ collective net worth has fallen about $5.5 trillion, or more than 8.6 percent, according to the Federal Reserve.

The bulk of that decline is in real estate, which has lost $4.7 trillion in value, or 22 percent, since 2007. In Arizona, for example, more than half of homeowners live in houses that are worth less than their purchase prices, according to some reports.

Stock investments aren’t any better. Since 1999, the Standard & Poor’s index, on a price basis, is off 17 percent. It’s up 3.2 percent when dividends are included, but that’s a small return for that length of time.

“This is really a lost decade of affluence,” says Sam Stovall, chief investment strategist at Standard & Poor’s in New York.

Among those who have watched their finances deteriorate are senior citizens.

“Given the stock market, they are very nervous,” says Nancy LeaMond, executive vice president at AARP, the seniors’ lobbying group. “They want to keep their savings.”

But Ms. LeaMond also notes that about 2 in every 3 seniors are dependent not on Wall Street but on Social Security. The average annual income for those over 65 is $18,500 a year – almost all of it from Social Security, she says. “This is not a part of America that is rich,” she says.

But Ms. LeaMond also notes that about 2 in every 3 seniors are dependent not on Wall Street but on Social Security. The average annual income for those over 65 is $18,500 a year – almost all of it from Social Security, she says. “This is not a part of America that is rich,” she says.

At the same time, seniors are getting pinched in their pocketbooks.

“Our members are watching all the things they have to buy, especially health-care products, go up in price,” says LeaMond.

In Pompano, Fla., some stretched seniors end up at the Blessings Food Pantry, which is associated with Christ Church United Methodist.

“We have quite a few grandparents who are raising their grandchildren on a fixed income, feeding them and buying clothes for them when they can’t afford to do [that for] themselves,” says Yvonne Womack, the team leader.

Others, she says, are forgoing food to pay for their medical prescriptions. “And then there is your ordinary senior whose Social Security [check] has not gone up in the last several years, but food and gasoline [prices] have skyrocketed,” she says. (However, Social Security checks will go up 3.6 percent in January.) The Blessings, she notes, is now feeding 42 percent more people than last year. “We also provide food you can eat out of a can,” she says. “We do have seniors who are living on the streets.”

by Ron Scherer, Christian Science Monitor

The Biggest Rip Off Ever

by Mike Whitney

Counterpunch

from the July 2009 Archives, a good review that you need!

Is it possible to make hundreds of billions of dollars in profits on securities that are backed by nothing more than cyber-entries into a loan book?

It’s not only possible; it’s been done. And now the scoundrels who cashed in on the swindle have lined up outside the Federal Reserve building to trade their garbage paper for billions of dollars of taxpayer-funded loans. Meanwhile, the credit bust has left the financial system in a shambles and driven the economy into the ground like a tent stake. The unemployment lines are growing longer and consumers are cutting back on everything from nights-on-the-town to trips to the grocery store. And it’s all due to a Ponzi-finance scam that was concocted on Wall Street and spread through the global system like an aggressive strain of flu. This isn’t a normal recession; the financial system was blown up by greedy bankers who used “financial innovation” game the system and inflate the biggest speculative bubble of all time. And they did it all legally, using a little-known process called securitization.

Securitization–which is the conversion of pools of loans into securities that are sold in the secondary market–provides a means for massive debt-leveraging. The banks use off-balance sheet operations to create securities so they can avoid normal reserve requirements and bothersome regulatory oversight. Oddly enough, the quality of the loan makes no difference at all, since the banks make their money on loan originations and other related fees. What matters is quantity, quantity, quantity; an industrial-scale assembly line of fetid loans dumped on unsuspecting investors to fatten the bottom line. And, boy, can Wall Street grind out the rotten paper when there’s no cop on the beat and the Fed is cheering from the bleachers. In an analysis written by economist Gary Gorton for the Federal Reserve Bank of Atlanta’s 2009 Financial Markets Conference titled, “Slapped in the Face by the Invisible Hand; Banking and the Panic of 2007″, the author shows that mortgage-related securities ballooned from $492.6 billion in 1996 to $3,071.1 in 2003, while asset backed securities (ABS) jumped from $168.4 billion in 1996 to $1,253.1 in 2006. All told, more than $20 trillion in securitized debt was sold between 1997 to 2007. How much of that debt will turn out to be worthless as foreclosures skyrocket and the banks balance sheets come under greater and greater pressure?

Deregulation opened Pandora’s box, unleashing a weird mix of shady off-book operations (SPVs, SIVs) and dodgy, odd-sounding derivatives that were used to amplify leverage and stack debt on tinier and tinier scraps of capital. It’s easy to make money, when one has no skin in the game. That’s how hedge fund managers and private equity sharpies get rich. Securitization gave the banks the opportunity to take substandard loans from applicants who had no way of paying them back, and magically transform them into Triple A securities. “Abra-kadabra”. The Wall Street public relations throng boasted that securitization “democratized” credit because more people could borrow at better rates since funding came from investors rather than banks. But it was all a hoax. The real objective was to turbo-charge profits by skimming hefty salaries and bonuses on the front end, before people found out they’d been hosed. The former head of the FDIC, William Seidman, figured it all out back in 1993 when he was cleaning up after the S&L fiasco. Here’s what he said in his memoirs:

“Instruct regulators to look for the newest fad in the industry and examine it with great care. The next mistake will be a new way to make a loan that will not be repaid.”

That’s it in a nutshell. The banks never expected the loans would be paid back, which is why they issued them to applicants with no income, no collateral, no job, and a bad credit history. It made no sense at all, especially to anyone who’s ever sat through a nerve-wracking credit check with a sneering banker. Trust me, bankers know how to get their money back, if that’s their real intention. In this case, it didn’t matter. They just wanted to keep their counterfeiting racket zooming ahead at full-throttle for as long as possible. Meanwhile, Maestro Greenspan waved pom-poms from the sidelines, extolling the virtues of the “new economy” and the permanent high plateau of prosperity that had been achieved through laissez faire capitalism. Why would anyone care what Greenspan thinks? The Fed is just a branch office of the banking cartel anyway.

That’s it in a nutshell. The banks never expected the loans would be paid back, which is why they issued them to applicants with no income, no collateral, no job, and a bad credit history. It made no sense at all, especially to anyone who’s ever sat through a nerve-wracking credit check with a sneering banker. Trust me, bankers know how to get their money back, if that’s their real intention. In this case, it didn’t matter. They just wanted to keep their counterfeiting racket zooming ahead at full-throttle for as long as possible. Meanwhile, Maestro Greenspan waved pom-poms from the sidelines, extolling the virtues of the “new economy” and the permanent high plateau of prosperity that had been achieved through laissez faire capitalism. Why would anyone care what Greenspan thinks? The Fed is just a branch office of the banking cartel anyway.

Now that the securitization bubble has burst, 40 per cent of the credit which had been coursing into the economy has been cut off triggering a 1930′s-type meltdown. Fed chief Bernanke has stepped into the breach and provided a $13 trillion dollar backstop to keep the financial system from collapsing, but the broader economy has continued its historic nosedive. Bernanke is trying to fill the chasm that opened up when securitization ground to a halt and gas started exiting the credit bubble in one mighty whooosh. The deleveraging is ongoing, despite the Fed’s many programs to rev up securitization and restore speculative bubblenomics. Bernanke’s latest brainstorm, the Term Asset-backed securities Lending Facility (TALF), provides 94 per cent public funding for investors willing to buy loans backed by credit card debt, student loans, auto loans or commercial real estate loans. It’s a “no lose” situation for big investors who think that securitized debt will stage a comeback. But that’s the problem; no one does. Attractive, non recourse (nearly) risk free loans have failed to entice the big brokerage houses and hedge fund managers. Bernanke has peddled less than $30 billion in a program that’s designed to lend up to $1 trillion. It’s been a complete bust.

To understand securitization, one must think like a banker. Bankers believe that profits are constrained by reserve requirements. So, what they really want is to expand credit with no reserves; the equivalent of spinning flax into gold. Securitization and derivatives contracts achieve that objective. They create a confusing netherworld of odd-sounding instruments and bizarre processes which obscure the simple fact that they are creating money out of thin air. That’s what securitization really is; undercapitalized junk masquerading as precious jewels. Here’s how economist Henry CK Liu sums it up in his article “Mark-to-Market vs. Mark-to-Model”:

“The shadow banking system has deviously evaded the reserve requirements of the traditional regulated banking regime and institutions and has promoted a chain-letter-like inverted pyramid scheme of escalating leverage, based in many cases on nonexistent reserve cushion. This was revealed by the AIG collapse in 2008 caused by its insurance on financial derivatives known as credit default swaps (CDS)…..

The Office of the Comptroller of the Currency and the Federal Reserve jointly allowed banks with credit default swaps (CDS) insurance to keep super-senior risk assets on their books without adding capital because the risk was insured. Normally, if the banks held the super-senior risk on their books, they would need to post capital at 8 per cent of the liability. But capital could be reduced to one-fifth the normal amount (20 per cent of 8 per cent, meaning $160 for every $10,000 of risk on the books) if banks could prove to the regulators that the risk of default on the super-senior portion of the deals was truly negligible, and if the securities being issued via a collateral debt obligation (CDO) structure carried a Triple-A credit rating from a “nationally recognized credit rating agency”, such as Standard and Poor’s rating on AIG.

With CDS insurance, banks then could cut the normal $800 million capital for every $10 billion of corporate loans on their books to just $160 million, meaning banks with CDS insurance can loan up to five times more on the same capital. The CDS-insured CDO deals could then bypass international banking rules on capital. (Henry CK Liu, “Mark-to-Market vs. Mark-to-Model”

The same rule applies to derivatives (CDS) as securitized instruments; neither is sufficiently capitalized because setting aside reserves impairs one’s ability to maximize profits. It’s all about the bottom line. The reason credit default swaps are so cheap, compared to conventional insurance, is that there’s no way of knowing whether the dealer has the ability to pay claims. Its fraud, on a gigantic scale, which is why the financial system went into full-blown paralysis when Lehman Bros defaulted. No one knew whether trillions of dollars in counterparty contracts would be paid out or not. There are simply more claims on wealth than there is money in the system. Bogus mortgages and phony counterparty promises mean nothing. “Show me the money”. The system is underwater, and it cannot be fixed by more of the Fed’s presto liquidity.

The shadow banking system has collapsed, not because the market is “frozen” or because investors are in a state of panic after Lehman, but because derivatives and securitization have been exposed as a fraud propped up on insufficient capital. It’s snake oil sold by charlatans. That’s why European policymakers are resisting the Fed’s requests to create a facility similar to the TALF to start up securitization again.

Bernanke’s job is to step in and put an end to the hanky-panky, not add to the problems by restoring a credit-generating regime that transferred hundreds of billions of dollars from hard-working people to fatcat banksters and Wall Street flim-flammers.

Statement Released By The Wall Street Protesters

“general assembly” statement read by Keith Olbermann

CNN Defends TARP, Paints Wall Street Protesters as a Joke

You don’t have to agree with Occupy Wall Street to see the arrogance of the “mockers.” If the nation made money on the bank bailout, where has that money gone? They spend it without accountability. Media ignorance gone to seed…

Video: How the Banks Won

Obama & Dragnet 2010: A Little Humor

“no comment” ~ E.J.

Occupy Wall Street Recap

Whether you agree or not, here it is, yoga included. ~ E.J.

What would keep investors happy? An interview with a Wall Street trader. It’s all about the money.

Alessio Rastani:: …it’s gonna crash and it’s gonna fall pretty hard. Because markets are ruled right now by fear. Investors and the big money, the smart money …I’m talking about the big funds, the hedge funds, the institutions, they don’t buy this rescue plan. They basically know that the market is toast. They know that the stock market is finished, the Euro as far as they’re concerned they don’t really care, they’re moving their money away to safer assets like Treasury bonds, 30 year bonds, and the US dollar. So it’s not gonna work.

Maxine Croxall:: We keep hearing that whatever the politicians are suggesting — it’s all been rather wooly — isn’t right. Can you pin down exactly what would keep investors happy, make them feel more confident?

Alessio Rastani:: Ah, that’s a tough one. Personally, it doesn’t matter. I’m a trader, I don’t really care about that kind of stuff. If I see an opportunity to make money, I go with that. So for most traders we don’t really care that much how they’re going to fix the economy, how they’re going to fix the whole situation. Our job is to make money from it and personally I’ve been dreaming of this moment for three years. Personally, I have a confession to make, I go to bed every night and I dream of another recession. I dream of another moment like this. Why? Because people don’t seem to maybe remember, but the ’30’s depression, the Depression of the ’30’s wasn’t just about a market crash. There were some people who were prepared to make money from that crash and I think anybody can do that. It isn’t just for some people in the elite, anybody can actually make money, it’s an opportunity. When the market crashes, when the Euro and the big stock markets crash, if you know what to do, if you have the right plan to set up you can make a lot of money from this. For example, hedging strategies is one, then investing in bonds, Treasury bonds that sort of stuff.

Maxine Croxall:: If you could see the people around me, jaws have collectively dropped at what you’ve just said. I mean we appreciate your candor, but it doesn’t help the rest of us does it, or the rest of the Eurozone.

Alessio Rastani:: I will say this, listen. I would say this to everybody who’s watching this, this economic crisis is like a cancer. If you just wait and wait thinking this is going to go away, just like a cancer it’s gonna grow and it will be too late. What I would say to everybody is get prepared. This is not a time right now to wishful think that the Government is going to sort things out. The Governments don’t rule the world, Goldman Sachs rules the world. Goldman Sachs does not care about this rescue package neither does the big funds. So actually, I would actually tell people, I want to help people. People can make money from this, it isn’t just traders. What they need to do is learn about how to make money from a downward market. The first thing people should do is protect their assets, protect what they have because in less than 12 months, my prediction is that savings of millions of people is gonna vanish and this is just the beginning. So I would say, be prepared and act now. The biggest risk people can take right now is not acting.

Maxine Croxall:: Alessio Rastani thank you very much for talking with us.